Why Gold

"Gold is money, everything else is credit" J.P. Morgan, 1912

- John Maynard Keynes named gold the “barbarous relic” suggesting that its usefulness and, hence, its value, is antiquated. J.P. Morgan typified it rightly in his testimony before Congress in 1912, “Gold is money. Everything else is credit.”

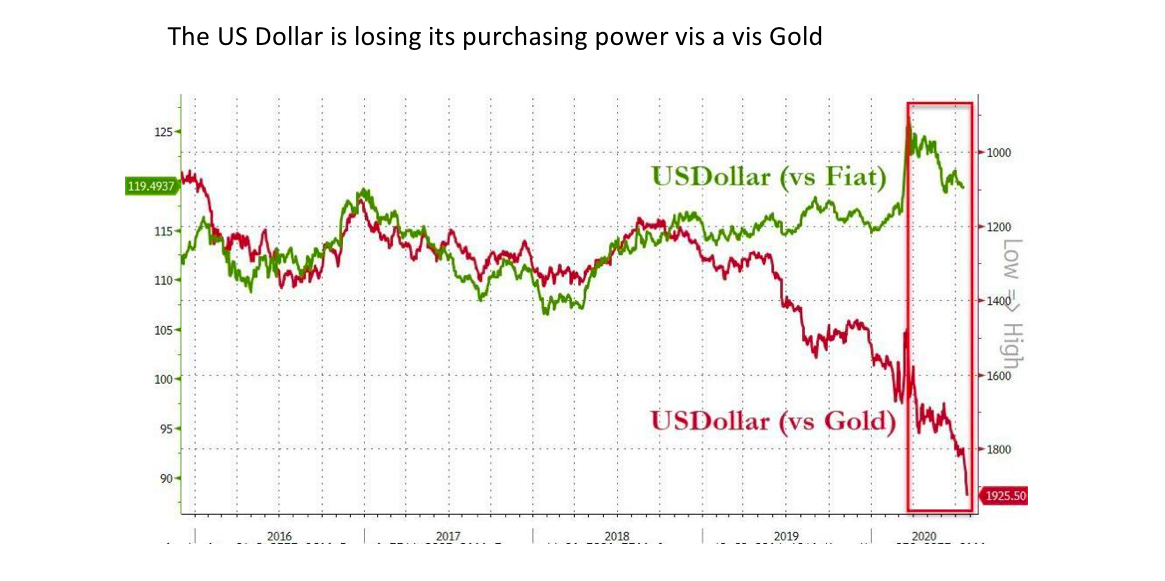

- If anything is a “barbarous relic” it is debt/paper money which has proven to continuously lose its value over time (see Dollar chart below). Paper money equates to unbridled printing, depreciating purchasing power and counter-party risk while physical gold and silver equal discipline, intrinsic value and no counter-party risk.

Gold should be looked at as a put/hedge towards Fiat Money

- For most of human history, at least 6,000 years, gold has been a medium of exchange, until August 1971, when Nixon took the world off the gold standard. This gave the US government a virtually unlimited money printing ability.

- Many people certainly still think of gold as money. Governments the world over own large amounts of gold and have recently begun increasing their ownership of gold.

- Gold should be more looked upon as a put/hedge towards fiat money. When fiat money fails gold should resume its historical role as the anchor of the financial system. The lower the purchasing power of the reserve currency, the higher the gold price in dollars. Gold and the reserve currency are in general inversely correlated, gold is expressed in US Dollars.

Gold is expressed in US Dollars, so either Gold or the US Dollar is strong or weak

The U.S. Exchange Stabilization Fund (ESF) was established at the Treasury Department by a provision in the Gold Reserve Act of January 31, 1934. The act authorized the ESF to use its capital to deal in gold and foreign exchange to stabilize the exchange value of the dollar. The ESF as originally designed was part of the executive branch not subject to legislative oversight! The price of gold is expressed in US dollars which is why there is an ongoing effort to suppress the gold and silver prices in order to make the US dollar look artificially strong and “credible” despite its fundamental weakness stemming from economic and monetary (huge debt and constant budget deficits) weaknesses.

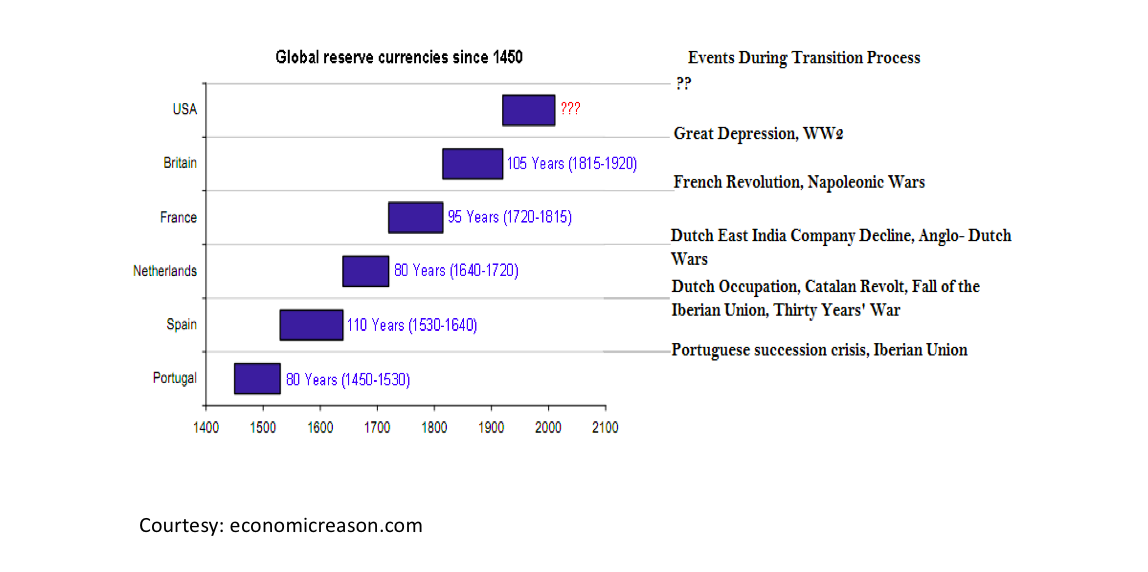

Reserve Currencies typically last for 80 to 110 Years

The reserve currency transition is a cycle that has typically lasted in history somewhere between 80 to 110 years. Officially, the US dollar has been the reserve currency for 68 years. However, the US dollar was used in trade long before, since the 1920’s in fact. That would give the US dollar closer to 90+ years as the reserve currency.

The Transition of Reserve Currencies brings Turmoil and Uncertainty

Throughout history, a transition of the reserve currencies has always brought about turmoil and uncertainty in financial markets. One country’s decline, and the subsequent rise of another, marks a radical transformation for the world, especially as market demand shifts. The country that dominates global commerce during any given period is usually marked with the status of having the reserve currency. Spain and Portugal dominated the 15th and 16th centuries, the Netherlands the 17th century, France and Britain the 18th and 19th centuries, and the US dominated the 20th century.

Currency Strength is all about Backing and Credibility

- Backing (deposits, gold and silver inventory) is the crux of the financial system. In the end the reserve currency, economic strength and military hegemony go hand in hand. The US Dollar was backed by gold until August 1971 when Nixon took the US dollar off the Gold Standard. This was replaced by the Petro-Dollar which was an idea of Kissinger whereby the Saudis would price oil in US dollars and agreed to use the received US dollars to invest in US Treasuries, thereby keeping the US dollar strong, in return for America’s protection. This was designed to give the US Dollar backing and credibility.

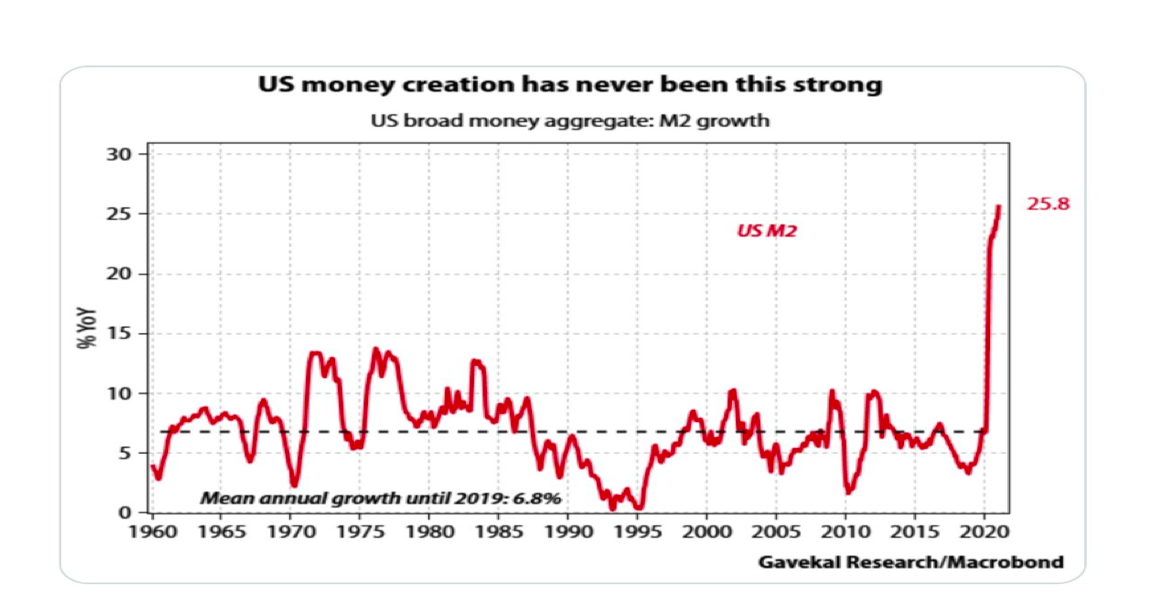

- In recent years several countries such as Russia, China and Iran have abandoned the pricing of oil in US dollars in order to break the US dollar hegemony and the US government ability to issue almost limitless amounts of debt i.e. treasuries. Next to that at present we are witnessing an accelerated debasement and undermining of the US dollar following its increasing budget deficits and use of the printing press resulting in a Debt/GDP ratio of 130%.

- The loss of purchasing power of the currencies is a phenomenon we see happening all over the world in the EU, Japan and China and with global debts totaling $290trn repayment is an illusion. The enormous counter party risk demonstrated by the loss of purchasing power of the fiat currencies, will be met by a huge shift into real, tangible assets such as commodities like gold and silver.

- The deeper underlying reason behind this is the fact that in the financial system of today hardly anything is backed with real cash (bank deposits, futures, derivatives). Almost everything is leveraged because of the historically low interest rates. Such a situation of limited backing can only be maintained when the system is healthy and when there are extreme and unbalanced situations the risks rise astronomically because of the potential snowball effect. This was illustrated with LTCM, the MBS crisis in 2008 and more recently with Archegos where transactions were invisible and were leveraged to the hilt.

Source:economicreason.com

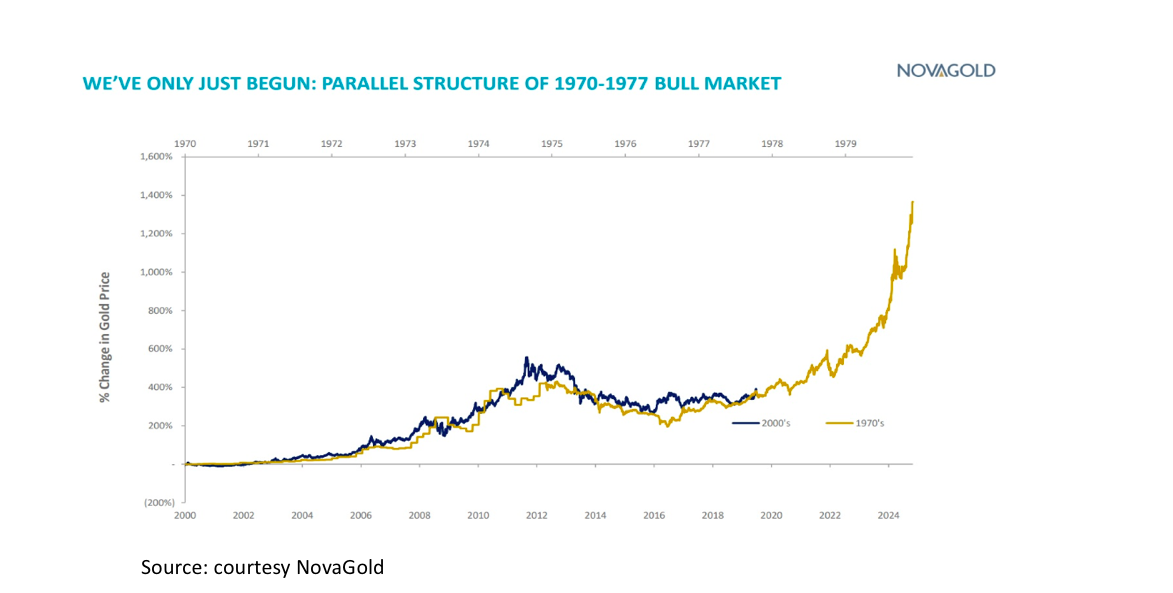

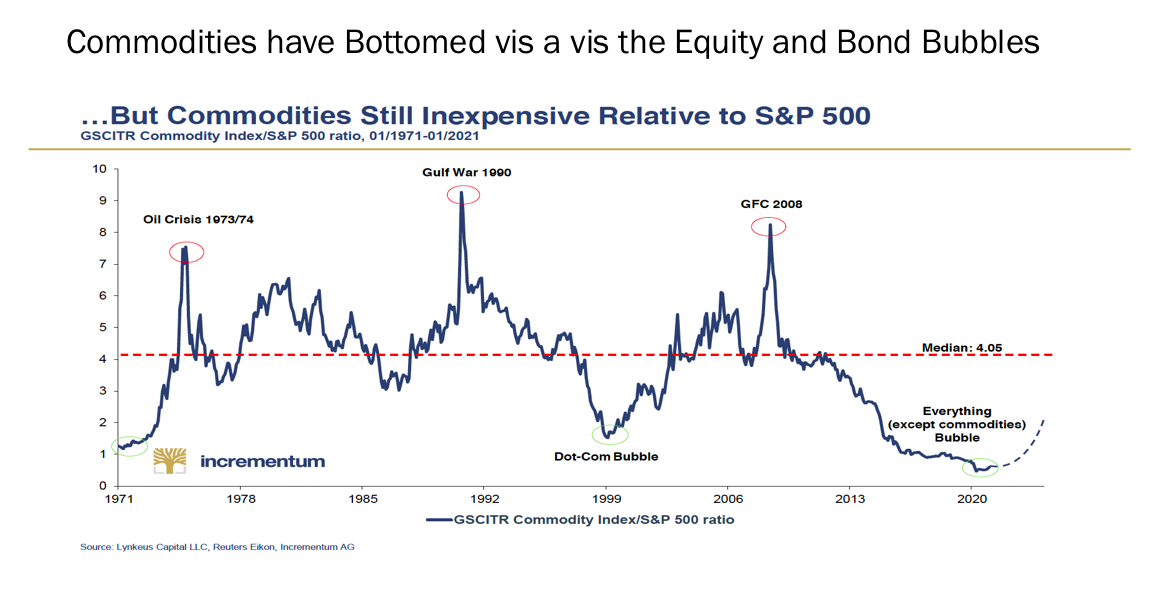

Commodities have bottomed vis a vis the equity and bond bubbles

As a result of the outperformance of the equity, especially the tech and biotech stocks, and bond markets there was no interest or incentive investing in hard assets and especially gold and silver. Next to that there were no reports of any elevated inflation. That picture has changed now following supply constraints and $10trn in stimulus resulting in the highest negative real interest rates (18%-2.5% or 15.5%, shadowstats.com) in our lifetime. Though investments in the hard asset sector except for lithium and uranium are still suppressed with investors still too optimistic that the situation will resolve itself. With the lead time from exploration to production depending on the commodity being at least 5-7 years before the mine can pore metal a lot of catching up will have to be done. The chart below clearly shows that we are at the beginning of a new secular bull market that is forecast to last at least 7-10 years.

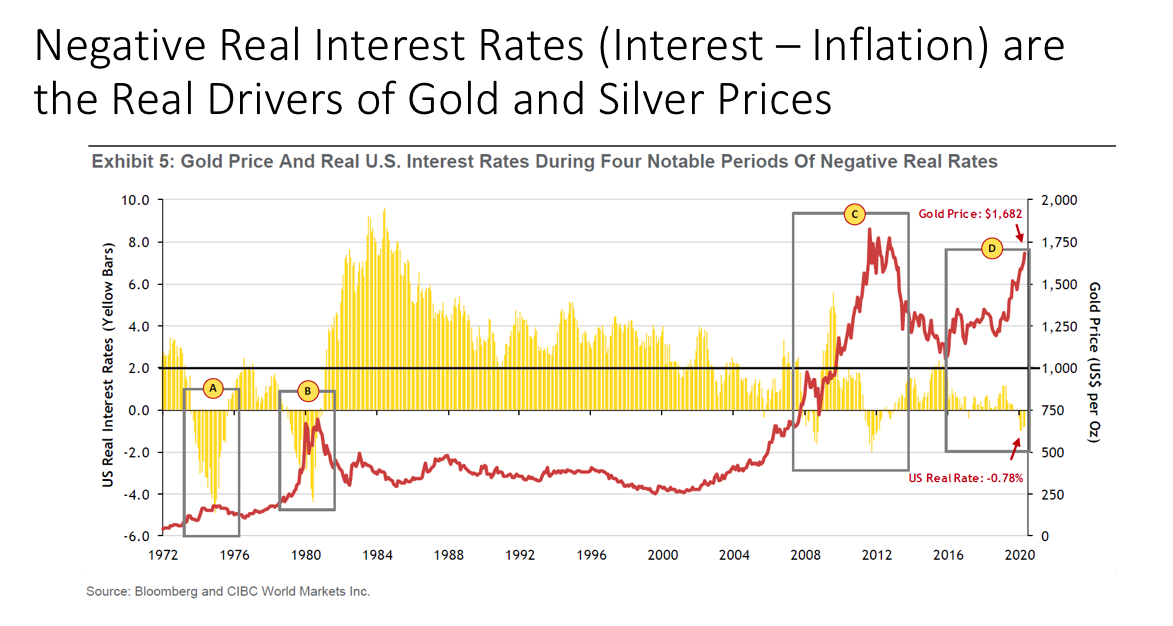

Negative Interest Rates (Inflation exceeds Interest) Fuel Gold Prices

Next to the historically low interest rates prompted to stimulate economic growth and needed in order to prevent the debt structure from imploding the low cost of money has created negative real interest rates (interest rate-inflation rate=negative). When interest rates don’t cover the inflation rate the value of money declines and because the US dollar is expressed and thus inversely correlated with the gold price the gold price goes up. In other words negative real interest rates are “compensated” by capital gains in the gold price.

Yearly Inflation Rates already running at 18% Per Annum

Shadowstats.com and Capwoodindex.org both show inflation rates of around 18% while the Fed Funds rate is 2.5%. In other words the negative real interest rate is 2.5% minus 18% for a negative 15.5%. From 1974 to 1980 negative real interest rates ranged between -0.5% and -6%. In June, 1981 the Federal Reserve board led by Volcker raised the federal funds rate, which had averaged 11.2% in 1979, to a peak of 20%. That would be impossible today because of the enormous government debt currently in excess of $29trn and a Debt/GDP ratio of 137%. In 1980 the government debt was $908 bn and the Debt/GDP ratio was 32%.

Source: economicreason.com

Scarcity and Lack of Suppression: Fuel Crypto Currencies

- It is a generally accepted rule that the precious metals are being suppressed in order to make the US dollar look strong. Bitcoin and other crypto currencies have been very strong performers because they are scarce and there is limited number of coins that can be issued, unlike paper dollars that can be printed ad infinitum. Next to that the crypto currencies are not suppressed yet because they are not yet considered as a threat to the fiat currencies. That might be changing as evidenced by Turkey outlawing bitcoin as a means of payment in order to prevent competition with the very weak Turkish Lira (a function of its weak economic conditions and monetary mismanagement).

- If we look at a chart of the total crypto market capitalization one could even argue that this chart should actually represent the price setting of the gold and silver prices without the usual price suppression.

Debasement of the Paper Currencies will Trigger the Purchases of Physical Gold

It is believed that it is just a matter of time before the price setting for physical gold and silver will break the manipulated paper gold and silver prices using naked (non-backed with physical ounces) paper futures. With the imbalances in the economies and government finances and the continuous debasement of the purchasing power of the currencies the more people want to own the real asset, the physical and not paper IOUs (like the US dollar or treasuries) because of their counter-party risk. The counter-party risk re the dollar is that it doesn’t keep its purchasing power. And the more the Fed, BIS and bullion banks keep the gold and silver prices suppressed under the weak monetary circumstances the more they trigger accelerated purchases of the physical gold and silver and thus creating their own demise.